San Lorenzo Gold Corp (TSXV: SLG) shares shot up 69% to close at $2.11 on January 26, 2026, after the gold and copper project developer reported assay results from the first hole of its current drill program at the company’s flagship Salvadora property in Chile.

San Lorenzo said it cut five sections of mineralization in the first hole totaling 222.4 metres (m). The company believes the mineralization represents the upper levels of a mineralized porphyry system and the results suggest continuation – to the northeast – of the system encountered in the first two holes drilled last year on the east side of the Cerro Blanco litho-cap feature.

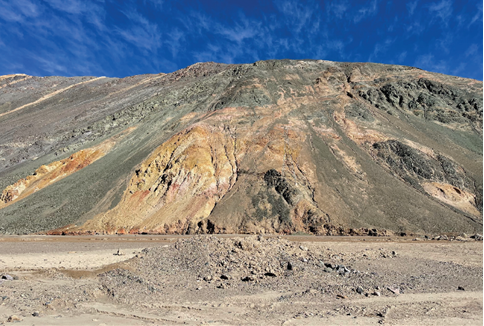

The company noted that it is hopeful that the system extends further to the northeast to where significant alteration can be seen from the valley floor, 1.7 kilometers (km) to the northeast.

San Lorenzo added that it will conduct a further induced polarization (IP) survey followed by more drilling.

Not to jump the gun here, but the company could be sitting on a big, big resource. Salvadora’s 9,000 plus hectare land package contains what the company considers to be five high-priority targets.

Previous drill results included 153.5m of 1.04 grams per tonne (g/t) gold from the maiden (discovery) hole at Cerro Blanco and 112m of 1.44 g/t gold from the maiden (discovery) hole at Caballo Muerto. The company believes Cerro Blanco is a “significant, newly identified gold-rich porphyry system” within the Salvadora property.

Salvadora is also situated just 15 km from Codelco’s El Salvador Mine, which has produced more than 26 billion pounds of copper and over 5.6 million ounces of gold.

Needless to say, these guys are hunting in ‘elephant country’.

San Lorenzo Gold has about 90 million shares outstanding, giving it a market cap of almost C$190 million.

Investor2M posts and articles are for informational purposes only, and are not a recommendation, solicitation, or research report relating to any investment strategy, security, or digital asset. All investments involve risk including the loss of principal and past performance does not guarantee future results.

Any information contained in this commentary does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. There is no guarantee that any statements or opinions provided herein will prove to be correct.